Do you need flood protection for your commercial property?

5/18/2020 (Permalink)

Do you need flood protection for your commercial property?

If you own a commercial property on the CT shoreline, you may be concerned about flooding and for good reason. The majority of general commercial insurance policies exclude damage caused by flooding. If your insurance policy does not cover ground flooding, consider whether you may need to add the coverage. There are a number of reasons why flood insurance for your commercial property is a good idea.

- Is your business located on a flood plain? The Federal Emergency Management Agency maintains flood maps that can help business owners determine whether a commercial building is located in an area prone to flooding. Most insurance providers define a flood as water damage that originates from outside water sources such as rain or rising bodies of water

- Are you a “better safe than sorry” business owner? Even if you are not in a flood plain, there may be a reasonable risk of flooding at your commercial building. According to FEMA, the average flood insurance claim is approximately $33,000 and total property damage due to flooding tops $6 billion every year. Because flooding can happen, you may choose to purchase insurance “just in case”.

- Is your mortgage federally regulated or insured? Owners of property located in a flood zone with mortgages regulated or insured by the federal government are required to purchase and maintain flood coverage. Contact an insurance agent that offers NFIP policies or add a flood endorsement or rider to a general commercial insurance policy.

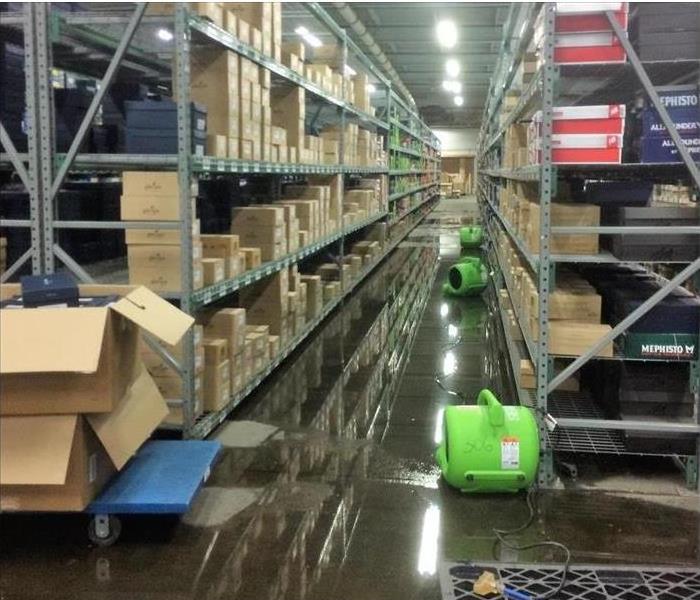

- Mold and Other Secondary Damage In addition to excluding flooding, most standard commercial property policies also cut out coverage for any secondary damage that results from this uncovered peril. Without a flood policy, it may be more difficult or prohibitively expensive to pursue mitigation and restoration. As a result, a structure may be prone to mold growth.

24/7 Emergency Service

24/7 Emergency Service